📊Decentralized exchange

www.arawancoin.com

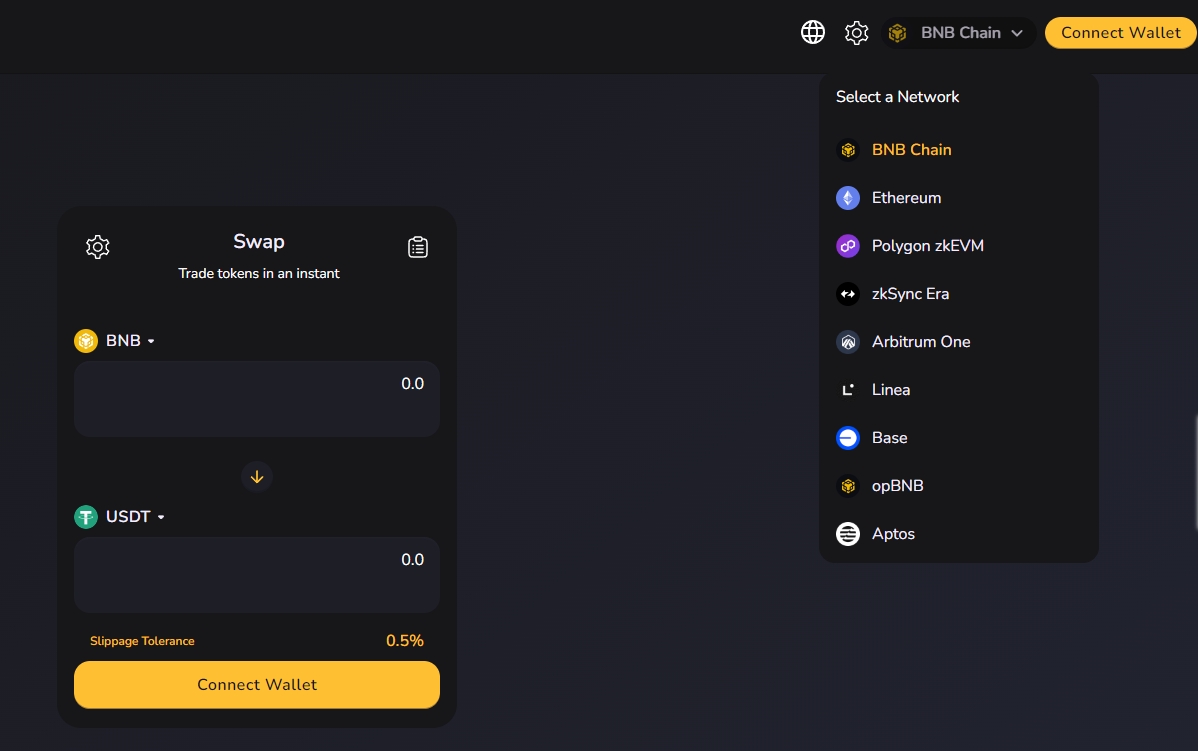

DEX exchange platform for BEP-20 tokens on the most stable Binance Smart Chain network. This network guarantees superior speeds and lower transaction costs

ARWCoin lets users swap BEP-20 coins without the need to go through a Centralized Exchange. All transactions are routed directly through your wallet, which is fully under your control.

Support Network

Ethereum blockchain

Binance Smart Chain

Polygon (MATIC),

Avalanche, Solana

Arbitrum blockchain

Fantom blockchain

Cronos blockchain

Celo blockchain

Near Protocol

Optimism blockchain

Feature of platform

- Staking

- Swap

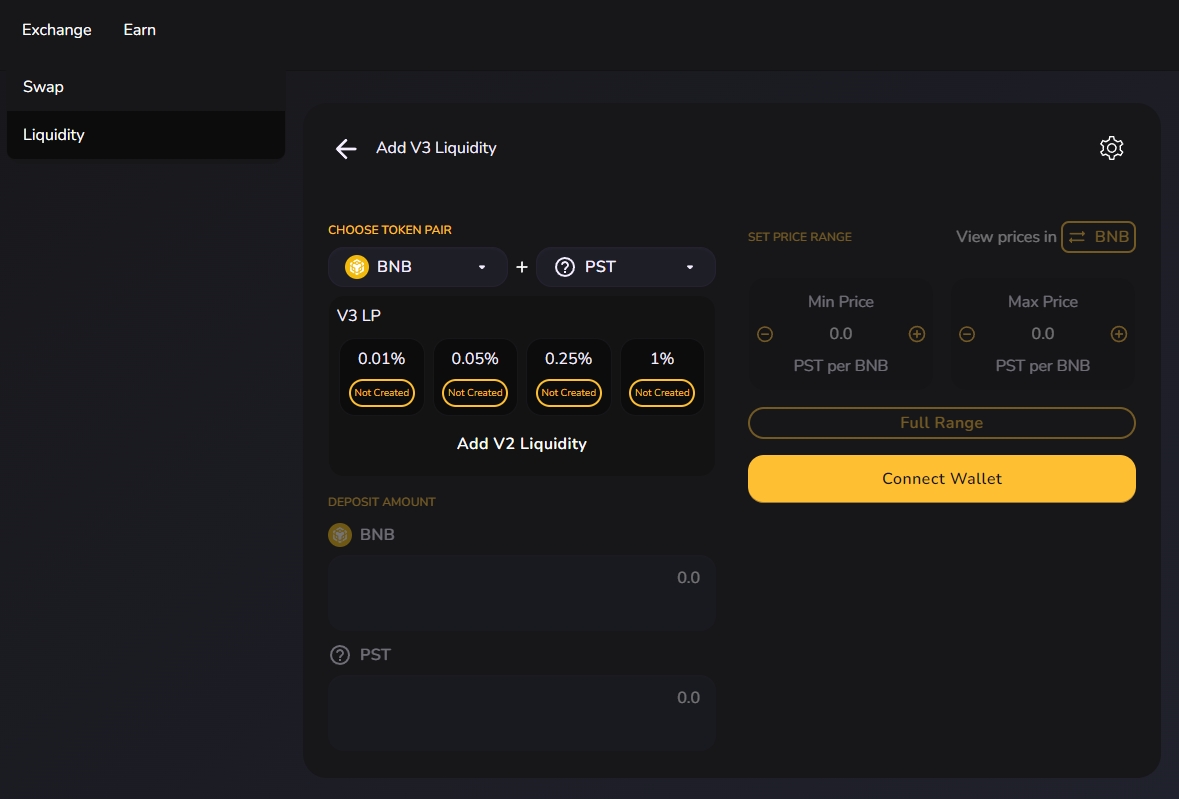

- Liquidity

Exchange Page

Users can swap their tokens through the Swap function. ARWSwap already created some mainstream trading pair liquidity pools. Users can swap between any two supported tokens by paying a 0.2% swap fee. ARWswap Exchange is an automated market maker (AMM) that allows a user to exchange two tokens on the Binance Smart Chain network. The liquidity provided to the exchange comes from Liquidity Providers ("LPs") who stake their tokens in Liquidity Pools. In exchange, a user gets LP tokens that can also be staked to earn ARW tokens in the "Farms".

Liquidity

Liquidity pool is used to facilitate swapping, loaning, perpetual contract, and options functions in ARW swap. We create ARW to USDT, BNB, and other mainstream trading pair liquidity pools in future When you add liquidity to the pool, you will get LP tokens. When someone makes a token swap, a transaction fee of 0.2% . The liquidity pool will also allow you to stake your LP tokens to earn ARW tokens in the “Farms”. Hence, apart from earning income from token swap transactions, a user will be able to stake LP tokens and earn ARW tokens.

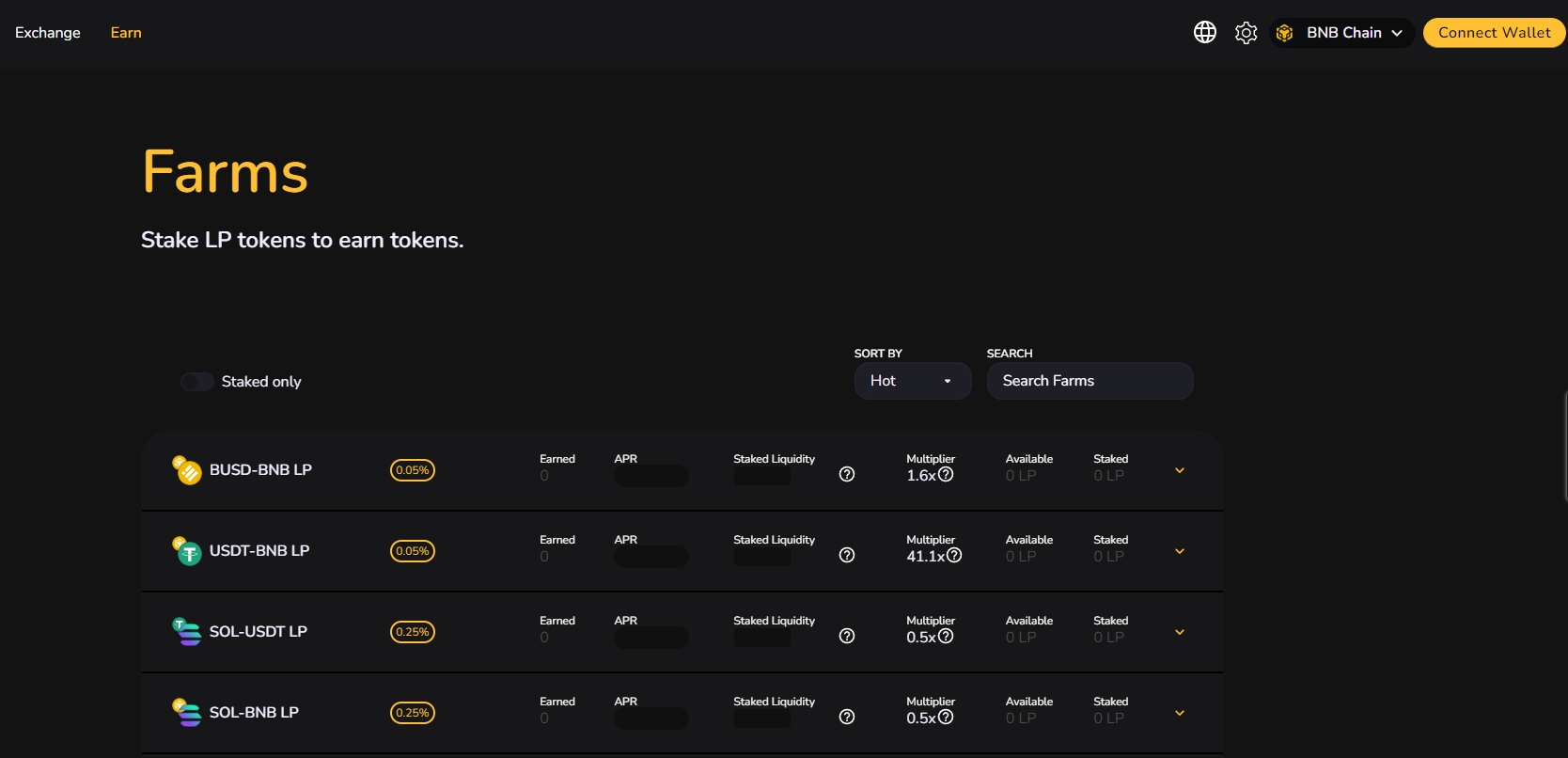

Farms

ARWSwap give better rewards than Syrup Pools, but it comes with a risk of imminent loss. It’s not as scary as it sounds, but it is worth learning about the concept before you get started.

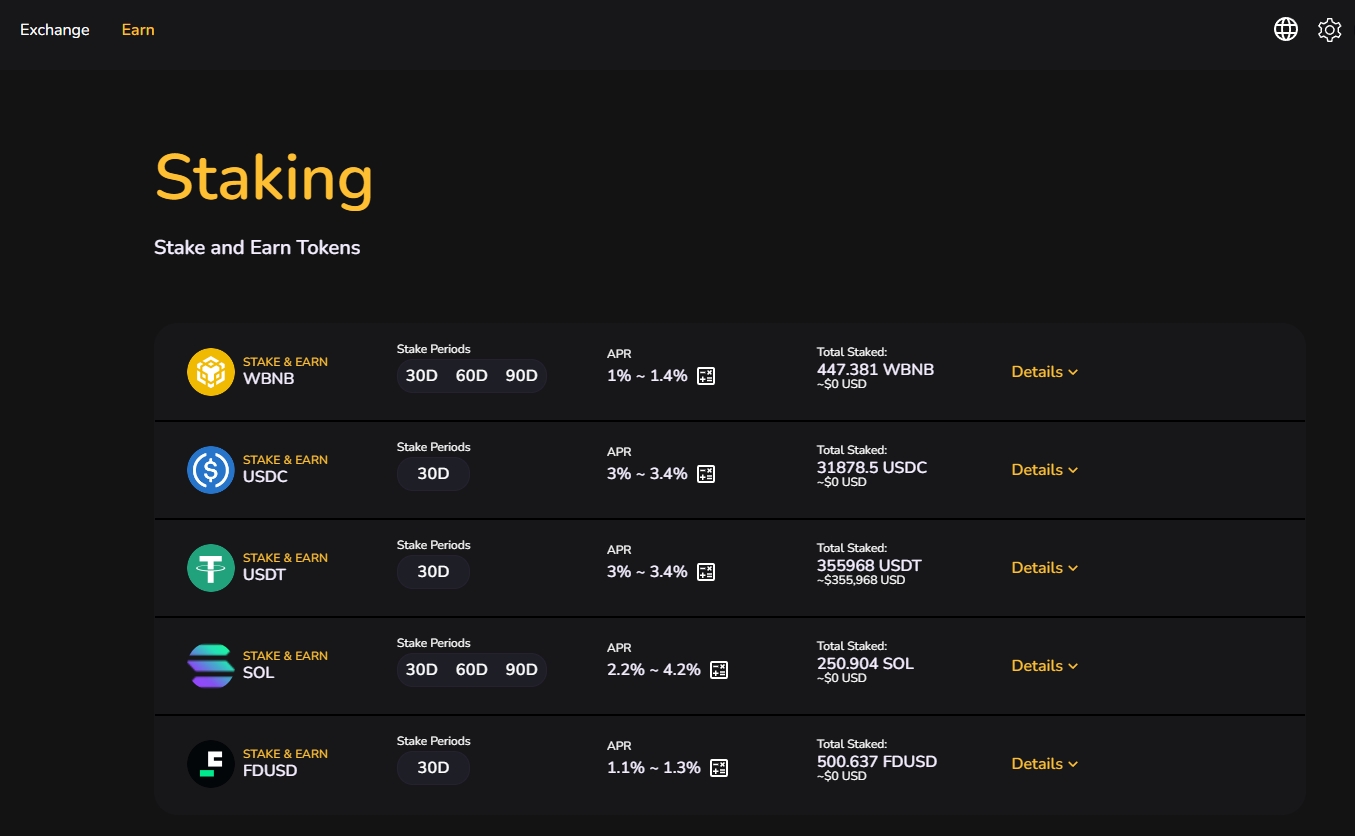

Staking

Staking is the best way to get profit from your ARW in Standard and Liquidity Pools High APY with no RISK!

Decentralized Exchange

A decentralized exchange (DEX) is a type of cryptocurrency exchange which operates in a decentralized manner, without a central authority. Instead of a centralized platform managing users' funds, a DEX allows users to trade directly with one another through an automated process facilitated by smart contracts. Here are some key features and benefits of DEXs:

Key Features of Decentralized Exchanges

No Central Authority: Unlike centralized exchanges (CEXs) that are managed by a single entity, DEXs operate on a blockchain network without a central authority.

Smart Contracts: DEXs use smart contracts to automate transactions. These are self-executing contracts with the terms of the agreement directly written into code.

User Control: Users maintain control of their private keys and funds, reducing the risk of hacking and theft associated with centralized exchanges.

Anonymity and Privacy: DEXs typically do not require users to go through extensive KYC (Know Your Customer) processes, thus providing more privacy.

Transparency: All transactions on a DEX are recorded on the blockchain, making them transparent and immutable.

Benefits of Decentralized Exchanges

Security: Since users control their own funds and private keys, the risk of hacking is minimized compared to centralized exchanges.

Reduced Fees: DEXs often have lower fees compared to CEXs because there is no intermediary.

Global Accessibility: Anyone with an internet connection and a compatible wallet can access a DEX, providing greater inclusivity.

Censorship Resistance: DEXs are harder to shut down or censor because they operate on a decentralized network.

Popular Decentralized Exchanges

Uniswap: One of the most popular DEXs, running on the Ethereum blockchain and using an automated market-making (AMM) system.

SushiSwap: A fork of Uniswap that adds additional features such as staking.

PancakeSwap: Operates on the Binance Smart Chain (BSC) and is known for its low transaction fees and high-speed transactions.

Curve Finance: Specializes in stablecoin trading with low slippage and fees.

Balancer: Allows users to create customizable liquidity pools and earn fees from traders.

How Decentralized Exchanges Work

Liquidity Pools: Users provide liquidity to pools by depositing their tokens, and in return, they earn a share of the trading fees.

Automated Market Makers (AMMs): These algorithms set the price of tokens within liquidity pools based on supply and demand.

Order Books: Some DEXs use off-chain order books to match buy and sell orders while settlement happens on-chain.

Considerations When Using a DEX

Liquidity: Some DEXs may have lower liquidity compared to major centralized exchanges, leading to higher slippage.

User Experience: The user interface of DEXs may be less intuitive than that of centralized exchanges.

Smart Contract Risks: There is always a risk of bugs or vulnerabilities in smart contracts.

Decentralized exchanges represent a significant shift in the way digital assets are traded, offering a more secure, private, and inclusive alternative to traditional centralized exchanges.

Last updated